Hello,

Welcome to Known Unknowns, a newsletter where markets are getting whacky—but hey, maybe this time is different.

Crypto Enters the Mainstream

Regular readers know I’m not a fan of the crypto phenomenon. I’m inherently uncomfortable with things that don’t make sense. At first, I thought my issue was that it violated everything I thought I understood about money. It’s not a currency by any definition. Then I realized I’m OK with that. I don’t get gold as a currency hedge either—and I can live with that too.

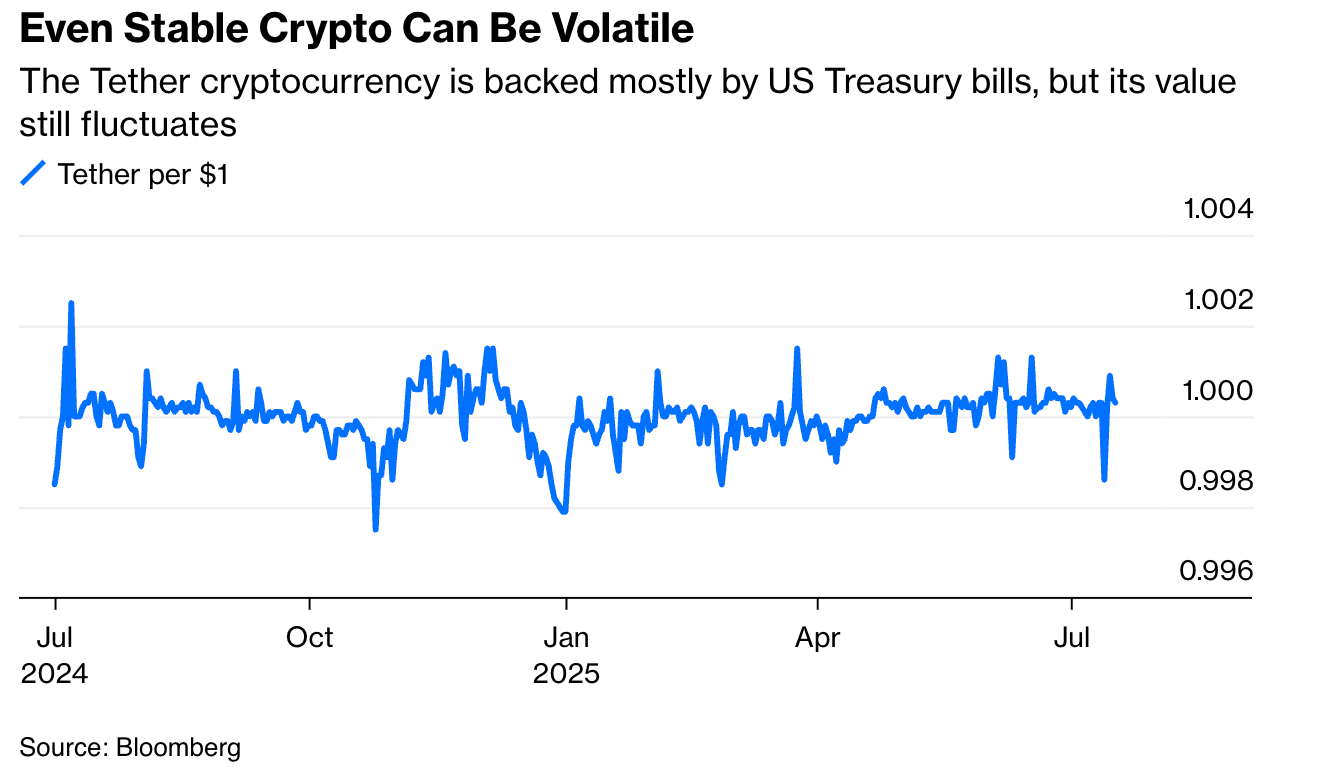

And no, stablecoin does not make crypto a viable currency. It does make it less volatile, I’ll give you that. I’ll also concede the payments system could be improved, especially when it comes to sending money overseas. But is this really the only way to solve that problem? It seems to me the dollar works pretty well for most transactions. Everyone accepts it, there are plenty of them, and it’s perfectly correlated with the… dollar—which means no currency risk if you buy stuff in America.

So why would you use some random currency issued by Walmart? I guess you might save on credit card swipe fees. But if we regulate stablecoins properly—make them invest in liquid, low-risk assets and monitor issuers closely—between compliance costs and low returns, they’ll have to charge fees too. Banks charge high fees largely to cover compliance costs, so if we regulate stablecoin issuers like banks—guess what? They’ll have to charge similar fees. Tell me again why you'd take on currency risk too?

But hey, people are weird. Or involved in crime. Or just like a little extra excitement when they buy stuff at Walmart.

Then I realized what really makes me uneasy: it’s that crypto is sold as a risk-free asset that also offers above-market returns (like, way above market). And we’ve seen that movie before—it never ends well. Throw in lots of unsophisticated investors going all in, and it just makes me nervous. I always assumed it would crash and burn and cause a lot of trouble along the way.

But now I’m rethinking that too. Between the Genius Act, which regulates stablecoin and effectively elevates it to a means of payment, and the executive order allowing more crypto in 401(k)s, it’s gone mainstream. It’s in the bones of the financial system. That makes the crash-and-burn scenario less likely (though still possible—after all, it’s a speculative asset with no intrinsic value). So instead, it’ll stick around, just lingering—for the risk-loving, the naive, and the paranoid—diverting capital from actual productive uses.

Another Thing About Markets That Makes No Sense

It’s the mystery of our time: how can we run up so much debt and the bond market barely shrugs? Yes, I realize interest rates are higher than they were in the 2010s. But they’re still low by historical standards—and I’d argue that’s mostly about inflation risk (which, of course, is connected to debt risk). Given our enormous debt levels and projected entitlements, it seems like the 10-year should be more like 7%.

I wrote for Bloomberg about why that might be. First, if you measure it properly, rates did increase with debt—even in the 2010s. Also, in spite of everything, U.S. debt is still seen as low-risk. But we all know what happens when you misclassify something as low-risk that isn’t…

Still, it gives America enough rope to hang itself with—because, let’s be honest, no one is taking it seriously. For all the debt freak-outs over OBBB, I didn’t hear any serious plan to reduce spending or increase taxes in a meaningful way. And these are the same people who called anyone worried about debt and interest rates in 2011 a crank.

What worries me is how little bandwidth America has now if something bad happens—a blockade of Taiwan, another pandemic—and then, if markets start doubting Treasuries’ risk-free status, things can get exponential.

Now They’ve Gone Too Far

I’m sorry to the non-New Yorkers who are tired of hearing about the mayoral race—but it’s just too crazy.

I wasn’t thrilled when I was told I should understand that the angry mobs yelling “globalize the intifada” meant it in a peaceful and loving way. Nor was I happy when it became acceptable to ignore the most basic laws of economics—the foundation of everything I believe is true—because of vibes or whatever. I carried on. After all, I’ve learned to accept crypto.

But when they told me City Comptroller Brad Lander was a competent bureaucrat and we should trust his judgment—that’s it. Now they’ve gone too far. They messed with the wrong Pension Geek. The gloves came off.

Managing the city’s pensions is his main job, and he did not do a good job. The funds averaged a 3% annual return during his tenure. And this was during one of the best bull markets in living memory. I could forgive that if he’d de-risked the pensions, fully funded them, and done some LDI. But no—he just made investing riskier and more political. In my opinion, that’s a dereliction of fiduciary duty. I wrote about it for City Journal—and then Lander shared it on social media! He said, “wait until I see the returns this year.” I guess we’ll see if the Lander investment view redeems itself.

Until next time, Pension Geeks!

Allison

In their current form, you could think of stablecoins as tokenized T-bills without any interest payment. Holders of stablecoins forego the interest in exchange for fungibility and the ability to hide their tracks (if they are criminals). And that’s the good case, since much of the money invested in stablecoins may not really be in T-bills but in all kinds of untrustworthy assets. And that’s the problem

I live my life, not worried about owning any expensive modern art. I don't want to waste my money on it, but if you do, that is fine. Won't affect me. Same with bitcoin, beany babies, Trump memorabilia, old comic books, and other "collectibles". My family will survive. I guess there are some things I just don't get !