Known Unknowns

Hello,

Welcome Known Unknowns, a newsletter about all the important things – your money, interest rates, and your dating prospects. This week from sunny Cambridge, Massachusetts, to celebrate Bob Merton’s career at his festschrift.

More Sex and the City?

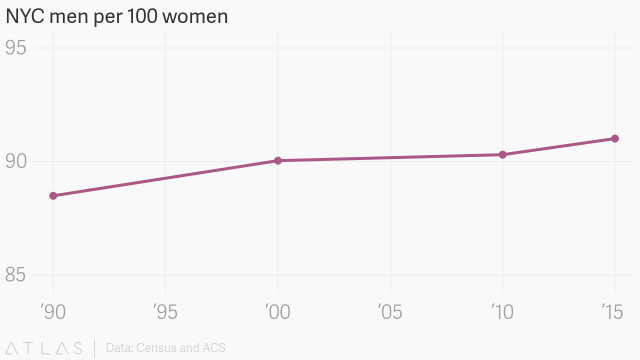

I recall in the 1990s and early 2000s lots of chatter about an urban man shortage. It even became an entertainment genre. Numerous articles claimed New York City was the inverse of Alaska when it comes to the male/female ratio. That never made sense to me. I spent time in Alaska, where the ratio is eight men for each woman, and you could go to a bar or restaurant and be the only woman—I never experienced an accidental all-women bar in New York.

In any case, while Alaska may still have a skewed gender ratio, big cities are moving toward gender parity.

I reckon the reason why is because of technology and gentrification. Skilled workers, of both genders, are now drawn to cities. Meanwhile, medium- and low-skill workers are priced out from high rents and fewer jobs. Before, low- and high-skill women lived in cities (low-skill male jobs tended to be in more rural areas, which explains the imbalance). But technology eliminated many administrative, clerical, and retail jobs— which means cities are increasingly just for the educated and upwardly mobile. Cities discriminate based on income and class, but they don’t favor any one gender. The result is more gender balance and hopefully the end of Bridget Jones-type characters.

The Fed and Negative Rates

The Fed, as expected, cut rates 25 basis points. To which the markets, said “meh.” That may be because, when the economy is humming, a rate cut does not do much. I suppose it is signaling or credibility. But, considering more components of inflation aren’t under the Fed’s control, a rate cut probably won’t do much to help the Fed reach its target. And yet – my goodness – people like to overestimate what the Fed can do. I guess they like to feel like someone is in charge.

A more interesting question is negative interest rates. Are they unnatural? They are unusual. For most of history (or starting in ancient Mesopotamia) you got paid to loan people money. But that was before there were risk-free assets. You could argue truly risk-free assets are new because they require low and predictable inflation. If an asset is risk-free, should it pay a positive return? Perhaps not.

I define natural as the market rate. If rates are low because that’s where the market sets them, then it is perfectly natural. But if there’s some distortion – say regulations that require large purchases of safe assets or monetary policy – then it is unnatural. I am not blaming the Fed for negative rates, mainly because I don’t think it has that much control over most interest rates.

The Debt

I’m on the hawkish side when it comes to debt. Yet, I can’t help but shrug at the latest spending bill and all the debt hawk theatrics. It’s not great to increase spending and continue a deficit financed tax-cut when the economy is growing – but eh. If interest rates stay low, it’s probably not a big deal. But, of course interest rates could go up one day – and then we’ll have a problem. Let’s hope it’s not during a recession. The good news is that many things in the budget are discretionary, so in theory they can be cut if spending needs to fall one day.

Now entitlements can’t be cut (well, technically they can – but it never happens) and that makes them riskier and more expensive to finance. They are also an even bigger debt bomb. So all this debt posturing is nonsense if politicians aren’t talking seriously about reforming entitlements, which pose a much greater risk. The oddest thing I heard was this statement from Ro Kanna’s (congressmen from Silicon Valley) press people:

I am pleased that the budget deal lifts the debt ceiling and moves us past the austerity of the Budget Control Act. That said, I remain concerned that defense spending has increased $100 billion since President Trump took office and now represents nearly 60% of discretionary federal spending. We need to invest in debt-free college, technical apprenticeships, and Medicare for all. We also are losing our leverage by agreeing to a lifting of the debt ceiling for the remainder of this term, but then in turn handcuffing a future progressive president in 2021.

Now this is hooey. Reasonable people can disagree about our spending priorities, but military spending, which is discretionary, and starting two new HUGE entitlements are not equivalent – both in term of size, expense, and in terms of risk because one can be cut (if rates rise) and the other can’t.

Wealth v Income

The good news is that there is some discussion brewing on entitlements – or how and who should finance retirement.

There are two ways to think about the purpose of a 401(k). There’s the way almost everyone thinks about them (which I think is wrong): that they are vehicles to build wealth—which may or may not be spent. Or the way economists (and hardly anyone else) thinks about them, which is they should finance consumption in retirement like DB plans used to. This is not a trivial distinction because each view entails a totally different investment strategy.

Because I am firmly in the economist camp, I am excited about the SECURE Act. It is a big step forward in making 401(k)s more income-like. It makes offering annuities easier (to be fair, there needs to be some guidance around what annuities are acceptable), and 401(k) statements must include income projections (how this will be calculated is another issue, but it’s a great start).

The difference in opinion around what 401(k)s are for seems to be driving the debate around the SECURE act. If you think the goal is wealth (like Barron’s and WSJ editorial board do), then the legislation makes no sense. They have a point: people do need wealth in retirement for health expenses, etc. But everyone was happy with DB plans (if they had them), why do so many people object to making 401(k)s more DB-like[1]?

Meanwhile, the Ways and Means Committee is holding hearings on the Social Security 2100 Act. I am glad someone is talking about putting Social Security on firm financial footing. It would increase taxes (a lot) and increase benefits. It is also in the more income and less wealth camp, but it aims to increase the government’s role. No word on if it would remove tax incentives for 401(k) plans because, presumably, people would need less workplace savings.

But these two acts raise an important question: How much retirement income should come from the government and how much should individuals be responsible for? I don’t know for sure what the right balance is, both individuals and the government have a role to play here. But estimates suggest Social Security 2100 would be inefficient (too big) and depress growth.

It is also worth noting that the Social Security Act includes a very large tax increase on high earners. Think all the other things we want high earners and the wealthy to pay for: free college, UBI, and Medicare for all. High earners only have so much income we can tax. Thus, expanding Social Security may not be the top priority, especially because, with a few tweaks, we can get secure income from employer-based plans.

In Other News

New York Fed on a mission to shed biases and spot risks where no one else is looking.

Until next time, Pensions Geeks (and friends)!

Allison

[1] A separate but related question is to ask if people should automatically buy an annuity when the retire, unless they opt out. Some economists think so. I am not sure if that would be legal, and a default annuity may go a little too far. I am all about defaulting people into a sensible investment strategy, but I think at some point people need to make an active decision in their retirement, and the right annuitization level is too idiosyncratic to be a default.