Known Unknowns

Hello,

Welcome to Known Unknowns, a newsletter that can’t make sense of the bond market or private equity.

Can we blame stocks for inequality?

The FT ran an interesting figure that got some attention. It came from Goldman Sachs, of all places. It shows that the top 1% owns way more equity than ever before – and way more than anyone else. Wealth inequality appears to be showing up in equity markets. The estimates include both public and private markets (how private markets are valued is uncertain).

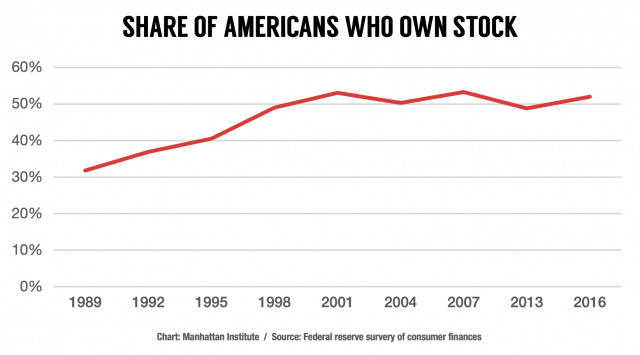

Though it is hard to make sense of this. First of all, in both private and public markets, institutional investors tend to be the biggest owners. If a pension fund owns lots of stock on behalf of firemen and teachers, does that count as stock ownership of the 90%? It also does not square with the fact that more Americans than ever own stock – mostly through their 401(k)s.

Maybe the share of stocks owned has become more unequal, but that does not take away from the benefits of more stock market participation. If we live in a world that rewards capital more than labor, more stock ownership spreads the growth around.

Still, the results are revealing, but not for the soak-the-rich, wealth tax message they appear to make (a good hedge on Goldman’s part, in my opinion). First, it suggests private markets are where the money is, getting into the 1% involves starting a company and keeping it private. Maybe we should be more concerned why so much wealth is now in private markets, either for structural or regulatory reasons. It also shows how hard a wealth tax would be to implement, if so many assets that drive inequality are difficult to value.

Incidentally, the French are protesting democratizing stock ownership. The protesters think it’s just fine, even just, that only 5% of French households own stock. I guess when it comes to inequality, you can’t please everyone.

Bond markets make no sense

The yield on 10-year Greek bonds fell under 1% last week. True, the Greek economy is growing, and the ECB will probably cut rates because of the coronavirus … but well, no. This is crazy. It is still Greece, and they have not made enough serious structural reforms since their last debt crisis. Just think. In 2000 when the United States ran a surplus the yield on a US bond 10-year bond was 6%! Last week, Greek bonds offered less yield than US bonds!

Are bond investors crazy or just desperate for positive yield? I suspect more the former. The demand for safe assets increased last week because of virus-related uncertainty. I suppose a 1% risky return sounds okay to some people in a negative rate world. But I still think it is nuts.

Lifting the cap and increasing debts

It is hard to cut pension benefits, just ask Greece or Macron (who still has not given up). Or look at the blowback from Trump’s newest budget. There are reports that he plans to “gut” Social Security and Medicaid even if the cuts are not even really cuts.

But something has to be done, which leaves tax increases. And many of the people running for president have a plan for that, i.e., increase the earnings cap – or levy the 12.4% payroll tax on earnings above $137,700. I find it alarming how casually people take such a large marginal tax increase. It is also worth noting it is not even sufficient to “fix” Social Security.

Would such a big tax increase introduce huge distortions and harm growth? Probably not, but if you live a state with high taxes, you could be looking at 60% taxes on your income. That does not leave much room for other things, like paying teachers more, infrastructure, free college, or health care.

I wonder if low interest rates have made people disconnected from fiscal reality. If rates are effectively 0, it does seem like you can borrow, tax, and spend forever. Jacking up the tax rates for Social Security may seem reasonable if you can borrow for everything else. But if rates ever do increase, that will be a problem.

So, will rates increase? Probably some day they will. They may be structurally lower than before because of demographics and more globally integrated financial markets, but demand may not be as stable as people think. Maybe Asian countries will buy less debt as their populations age, maybe there will be regulatory changes. If demand falls, rates will rise, and things could get ugly, especially if there's a recession and people are already paying 60% income taxes.

And don’t forget, Greece is offering less than 1% yield on its bonds! This is not a market I’d make a long-term bet on.

In Other News

Some regulations, in theory, can make markets more efficient, but not if they are layered on already over-regulated markets.

Another installment of the Quartz risk video series. There’s magic in this one!

No shame is small solutions to homelessness.

Retired Americans would like to be working more, but they need more flexible schedules. In that sense, the labor market seems inefficient to me.

Until next time, Pension Geeks!

Allison