Known Unknowns

Hello,

Welcome to Known Unknowns; it could be the only newsletter that believes people are rational and make good decisions—provided the data is presented to them in the right way.

Personal finance gets political

Maybe I’m a cock-eyed optimist, but I do believe that most people are capable of making good financial decisions—even risky decisions. Risk and financial science are relatively new, and so is the algorithm used to calculate credit scores. It is not shocking our minds don’t naturally understand this stuff, but that doesn’t mean we can’t learn if we are taught how (check out this video how). We’re born illiterate, but no one says that humans are inherently flawed and biased because someone needs to teach us to read. Yet, for some reason, if you don’t have a natural sense of probability theory, economists and psychologists will say that you have biases and that you need the government to take care of you.

It’s not surprising in this environment that politics has come from personal finance. A story in the New York Times asks whether we need an update on personal finance curriculum in our complex, changing world. The answer is probably yes. But the article takes a different turn, asking whether personal finance and its message of taking control of your life are actually harmful, because it distracts people from the real issue—inequality and the power of monopsony. I’m not sure what the implication is there. Instead of learning about compound interest and credit scores, should we school people in the nuances of local versus national monopoly power? Or, should we just tell them that the game is rigged and that they should vote for whatever favorite political candidate can get them stuff? I think that’s a bad way to go.

First of all, it needlessly politicizes something that is not political, which is a great way to turn people off. It also confuses basic facts with outright opinions.

There is evidence that people can make good risk decisions when they get the proper training. There is also evidence that personal finance classes work, provided that the curriculum is appropriate for the intended audience. People who receive good training have higher saving and rates of stock market participation. They are also less prone to fraud. It’s true that the economy has become riskier and harder to navigate, but that calls for more education, not undermining and patronizing people.

More on AB5

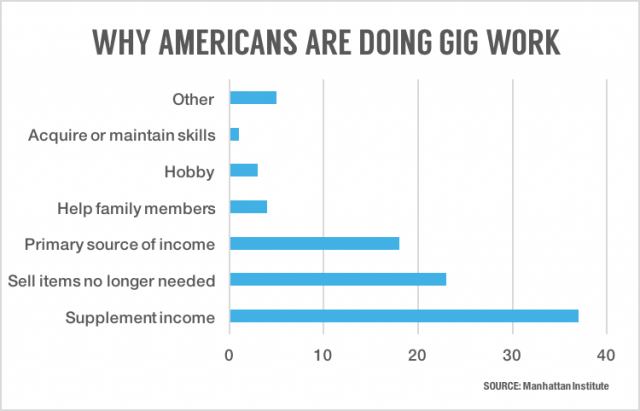

Despite all of the handwringing about the gig economy ruining work and financial stability, it turns out that the number of full-time contract workers has actually been fairly stable. Most people do gig work as a side-hustle in order to insure against income shocks. This is insurance, and it’s very valuable, especially for lower-income Americans.

However, policy makers aren’t having it. Take AB5 in California, which aims to make gig workers into regular workers with steady pay and benefits. But that undermines gig workers’ most valuable feature—flexibility. Many gig workers don’t want regular hours; they need to be available for childcare or their primary job.

It’s no small wonder there has been so much pushback on the law. It was well-intentioned—gig workers do need protections. This kind of work can be dangerous, and there is definitely room for exploitation. But the labor market has changed, and on-demand work has benefits in the new economy where matching with employers is easier and skills have become more uniform. This means that we need regulations that suit the new economy, not the old one.

Reason review

I really liked Bob Schiller’s most recent book, Narrative Economics, which takes the view that recessions are sometimes not caused by exogenous economic shocks, like an oil price increase, but by a viral story or public sentiment that drives consumer and investor behavior. Often, the story is not even true, but it can become a self-fulfilling prophesy.

The best part of his book is the economic history elements, which illustrate how narratives have shaped the economy for the last 100 years. Even if they don’t cause a recession, stories can prolong and deepen it.

Or, take data (another form of a story) on housing. Once house price data became more available, people began to see their home as an asset, and not just where they live, which caused more housing bubbles and pushed up prices.

After reading his book, I saw narratives everywhere—like that the rich face a lower tax rate, or that the wealth that an economy produces is finite and zero-sum.

However, I disagree that narratives take hold randomly, like a virus. I think there is more endogeneity to them, that sometimes we are more prone to narrative than at others, and that there are certain common features—such as us vs. them, stories of personal empowerment, or a strong man. People are susceptible to believe things depending on how data is presented to them, and we do know some things about what people connect with.

It’s worth remembering that some narratives are valuable because they can bind people together and encourage hard work. The American dream narrative—that anyone can achieve anything here—was probably never totally true, and it was always harder for some people to achieve than it was for others. But the belief in it was valuable, and it made American successful. Now, the narrative is taking hold that the dream is no longer possible, even if relative mobility rates haven’t changed all that much.

You can read Schiller’s book and believe two different things. You might think that there’s nothing new under the sun, and that people have always been prone to believe bad information presented in a compelling way, which has had big economic consequences. Or, you might think that with social media and big data, we’ll have more instability than ever before.

Risk aversion

Tyler Cowen argues that young people go into banking and consulting because they are risk averse. By the time they gain the skills and ability to take top jobs, they are too old to take big risks. He’s concerned that this explains declining productivity growth, because risk breeds innovation, which is how we get productivity.

But was there really a golden era of young risk-takers? It seems like before young Ivy League graduates went to McKinsey, they went to GE. People have always been status-driven and risk averse, especially the sort of people who do well on their SATs.

Now, it could be true that top jobs have become so complicated that they require more skills, training, and time in the labor force. Does that mean that lower productivity is the consequence of structural change? Perhaps it does, but I’m not convinced that that’s the problem. We discourage risk-taking in many ways that aren’t structural, and I think that’s both more concerning and easier to fix.

Also, many innovative firms have been founded by people over 40. Sometimes age means taking smarter—albeit fewer—risks.

In other news

The Atlantic argues that millennials are turning to socialism because housing is a better investment than education.

Even after the SECURE act, few plans are offering annuities.

Pensions funds hope lower fees will be enough to solve their funding crisis—no comment.

Until next time, Pension Geeks!

Allison